|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Exploring Reputable Mortgage Refinance Lenders for Smart Financial ChoicesRefinancing your mortgage can be a strategic move to reduce your monthly payments, shorten your loan term, or access home equity. Selecting a reputable lender is crucial to ensure a smooth process and favorable terms. Understanding Mortgage RefinanceMortgage refinance involves replacing your existing home loan with a new one, often with better terms. This can save money in the long run or provide immediate financial relief. Types of Mortgage Refinance

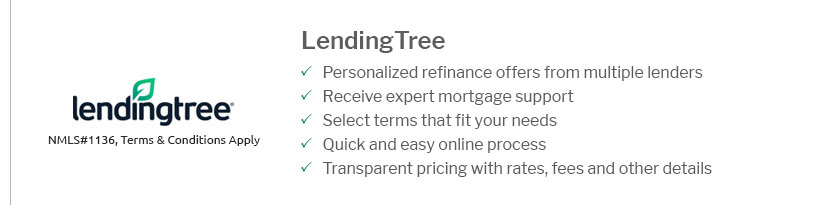

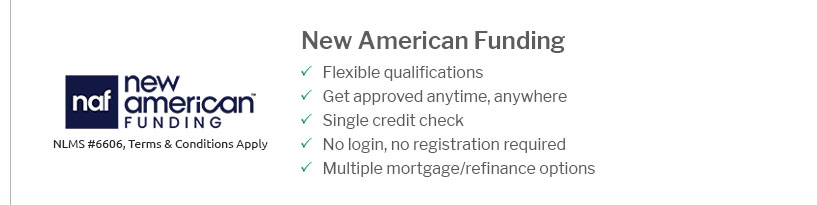

Choosing the right refinance option is vital. For example, you might want to refinance fha loan to conventional to take advantage of better interest rates. Qualities of Reputable LendersA reputable lender will offer transparency, competitive rates, and excellent customer service. Here are some key factors to consider: Transparency and ClarityEnsure that the lender provides clear information on fees, terms, and any potential penalties. Competitive Interest RatesInterest rates can significantly impact your monthly payments and overall loan cost. Compare rates across multiple lenders. Customer Reviews and ReputationCheck online reviews and ratings to gauge customer satisfaction and experiences with the lender. Steps to Refinance Your Mortgage

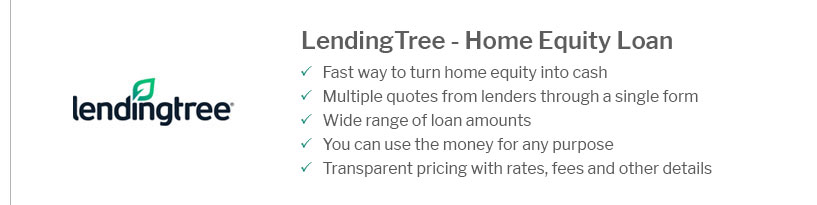

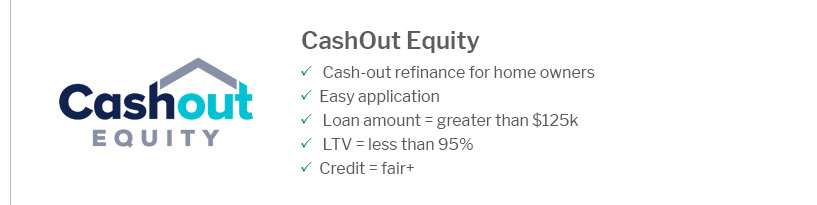

To maximize savings, consider exploring refinance home equity loan rates to find the best deal for your situation. Frequently Asked Questions

https://www.businessinsider.com/personal-finance/mortgages/best-mortgage-refinance-lenders

Rocket Mortgage is our top choice thanks to its easy-to-use online application and its strong track record in providing great customer service. https://finance.yahoo.com/personal-finance/mortgages/article/best-mortgage-refinance-lenders-161445533.html

The best mortgage refinance companies of January 2025 offer a combination of low fees and competitive interest rates. https://www.cnbc.com/select/best-mortgage-refinance-lenders/

CNBC Select has chosen the best lenders for a refinance mortgage in a number of categories. (See our methodology for more on how we made our selections.)

|

|---|